Little Known Questions About Commercial Insurance In Dallas Tx.

Wiki Article

The Greatest Guide To Home Insurance In Dallas Tx

Table of ContentsHow Health Insurance In Dallas Tx can Save You Time, Stress, and Money.Some Ideas on Truck Insurance In Dallas Tx You Should KnowSome Known Questions About Life Insurance In Dallas Tx.Facts About Health Insurance In Dallas Tx Uncovered

There are lots of different insurance plans, and recognizing which is best for you can be difficult. This guide will certainly discuss the various types of insurance policy and what they cover.It can cover routine check-ups as well as unforeseen diseases or injuries. Traveling insurance coverage is a plan that offers financial defense while you are taking a trip. It can cover trip terminations, shed luggage, clinical emergencies, as well as other travel-related costs. Travel medical insurance coverage is a plan that particularly covers clinical expenses while taking a trip abroad. If you have any kind of inquiries concerning insurance, contact us and also ask for a quote. They can aid you choose the right policy for your requirements. Contact us today if you desire customized solution from a licensed insurance coverage agent - Commercial insurance in Dallas TX.

Right here are a couple of reasons why term life insurance policy is the most preferred type. It is low-cost. The expense of term life insurance policy premiums is identified based on your age, health, and also the protection quantity you need. Specific sorts of service insurance policy might be lawfully required in some circumstances.

With PPO strategies, you pay greater regular monthly costs for the flexibility to use both in-network and also out-of-network carriers without a reference. Paying a premium is comparable to making a monthly vehicle repayment.

Some Of Home Insurance In Dallas Tx

When you have an insurance deductible, you are in charge of paying a certain quantity for insurance coverage solutions before your health insurance plan provides insurance coverage. Life insurance policy can be separated into 2 major kinds: term and also irreversible. Term life insurance policy gives protection for a specific period, normally 10 to thirty years, and also is more economical.We can't avoid the unexpected from occurring, yet in some cases we can secure ourselves as well as our families from the worst of the economic results. Four kinds of insurance that the majority of financial specialists advise consist of life, health, automobile, and also long-term handicap.

It consists of a survivor benefit and also a money worth component. As the worth grows, you can access the cash by taking a finance or withdrawing funds and also you can finish the policy by taking the money value of the policy. Term life covers you for a collection amount of time like 10, 20, or thirty years and also your costs stay stable.

2% of the American population was without insurance coverage in 2021, the Centers for Condition Control (CDC) reported in its National Facility for Wellness Data. Even more than 60% obtained their coverage through an employer or in the private insurance coverage industry while the remainder were covered by government-subsidized programs consisting of Medicare and Medicaid, veterans' benefits programs, and the government marketplace developed under the Affordable Care Act.

The Main Principles Of Life Insurance In Dallas Tx

According to the Social Security Management, one in 4 workers going into the workforce will certainly end up being impaired prior to they reach the age of retired life. While health insurance coverage pays for hospitalization as well as medical expenses, you are commonly burdened with all of the expenses that your paycheck had actually covered.

Almost all states need chauffeurs to have car insurance as well as minority that don't still hold vehicle drivers economically liable for any type of damages or injuries they trigger. Below are your choices when purchasing vehicle insurance policy: Obligation coverage: Pays for residential or commercial property damages and injuries you create to others if you're at mistake for an accident as well as additionally covers lawsuits prices as well as judgments or settlements if you're filed a claim against due to a car mishap.

Employer insurance this website coverage is basics frequently the most effective choice, but if that is not available, obtain quotes from numerous suppliers as numerous supply discounts if you buy greater than one kind of coverage.

The Buzz on Life Insurance In Dallas Tx

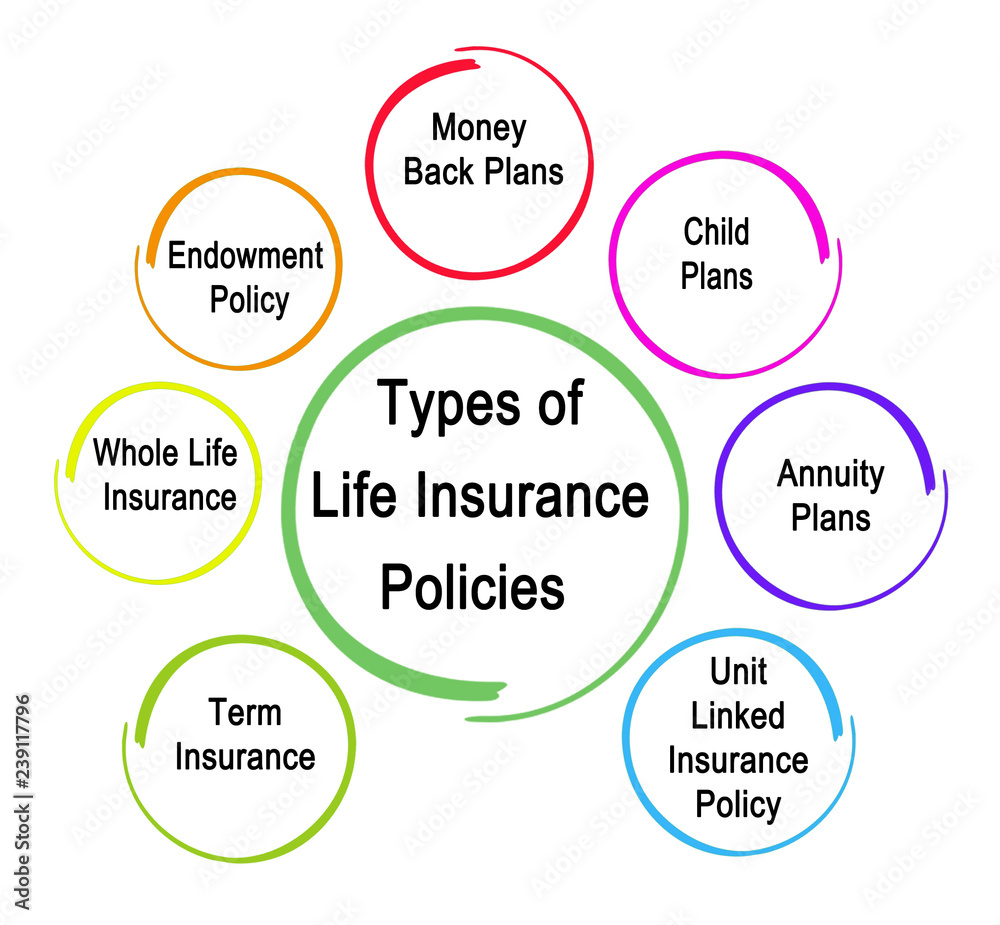

The ideal plan for you will certainly depend on your personal scenarios, just how much insurance coverage you need, and also just how much you intend to spend for it. This guide covers one of the most usual sorts of life insurance policy policies on the market, including details on exactly how they work, their advantages and disadvantages, how much time they last, and also who they're best for.

This is the most preferred sort my review here of life insurance policy for the majority of people since it's budget-friendly, only lasts for as long as you need it, and also features few tax policies and restrictions. Term life insurance policy is one of the simplest and also most affordable ways to provide a monetary safeguard for your loved ones.

You pay costs toward the plan, and if you pass away during the term, the insurance provider pays a collection amount of money, understood as the death benefit, to your assigned recipients. The death benefit can be paid out as a round figure or an annuity. Many individuals pick to receive the death benefit as a lump sum to prevent paying tax obligations on any made rate of interest. Commercial insurance in Dallas TX.

Report this wiki page